NOTES:

NOTES:

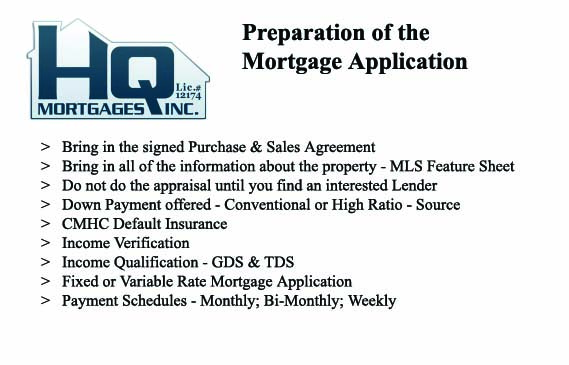

PREPARATION OF THE MORTGAGE APPLICATION

Once you find the house you want and you

have signed a Purchase and Sales Agreement, you will set up an

appointment with your Mortgage Agent to begin the process of

finding a lender who will best meet your particular needs.

You will bring in your Purchase and Sales

Agreement so that we can see the terms of the deal.

There are times when you might bring this

in to your mortgage agent even before you settle on the final

terms. This may be necessary if there is something unusual about

the terms. For example, your mortgage agent will explain some of

the options you can consider such as Vendor Take-Back mortgages

in order for you to be able to make the purchase. Our goal is to

help you purchase your property.

You will need to provide all of the

information you can about the house. Usually an MLS feature

sheet provided by the realtor will be suitable for this purpose.

You will most likely require an appraisal

for your new house, but we recommend that you hold off on that

until we find the lender. Some lenders have their own preference

when it comes to appraisals, so we ask that you hold off until

we have some idea of the most likely lenders for your situation.

It doesn't take long to get an appraisal, so there is no need to

spend money on an appraisal and then find out that the Lender

does not recognize that appraiser. It is better to wait until we

find you a Lender and then you can get the property appraised in

a manner that will satisfy the Lender.

DOWN PAYMENT

We will also need to consider the amount of

down payment you intend to put on the purchase. This may require

a discussion about whether you have the cash in hand; need to

convert some investments into cash; or if you will be receiving

a gift to help you with the down payment.

Your mortgage agent will explain that many

lenders are becoming much more vigilant when it comes to

disclosure and they look for warning signs of fraud. Your agent

will be able to advocate on your behalf by adding notes to the

mortgage application explaining any peculiarities, such as money

that has only been deposited from an unknown source for less

than a few months.

SOURCE OF DOWN PAYMENT

We are finding that more borrowers are

either borrowing the down payment from elsewhere or they are

receiving the down payment as a gift from family and/or friends.

If you borrow from another lending institution, that amount will

show up on your credit record. So if you have a good credit

record, it should not be a problem.

If you borrow from family and/or friends,

you will require them to sign a gift letter stating that the

money is a gift and there is no expectation of repayment. It is

important that this money is designated as a gift so that it

does not show up anywhere as a debt that you are carrying.

There are also some lenders who are giving

borrowers cash back mortgages. In this case, the borrower

borrows the money for the down payment and then the lender loans

the borrower the money as part of the mortgage so that the

borrower can pay the money back. This sounds nice, but it does

increase your mortgage and your monthly payments, so a mortgage

agent will make sure you understand the consequences of a cash

back mortgage.

One of the things we find is that lenders

are extremely flexible when it comes to the down payment. They

want to loan you the money, and they are very concerned about

your ability to pay the monthly payments, but they will consider

many different options when it comes to the downpayment.

In addition to the down payment, many

lenders require that you have at least 1.5% of the purchase

price available for closing costs. We too want to make sure

that you are able to handle the costs of getting into new

mortgage. We do not want to set you up for failure. Our

reputation depends on it so we would rather be truthful with you

than get you a mortgage that will result in extreme hardship for

you and your family.

CMHC DEFAULT INSURANCE

You will be required to have at least 5% of

the property’s value for a down payment. This means that if the

cost of your house is $300,000, you need $15,000 for a down

payment. That would mean you could qualify for a high ratio

mortgage and you would be required to pay default insurance to

CMHC.

Mortgages are defined as being either

conventional or high ratio. In order to determine whether your

mortgage is conventional or high ratio, you take the value of

your mortgage and the value of your house/property and if the

loan-to-value ratio is less than 80% it is a conventional

mortgage. If it is higher, it is a high ratio mortgage.

Mortgage lenders such as banks, trust

companies, credit unions and insurance companies are regulated

by either the Federal or Provincial governments and are not

normally allowed to provide a loan that is more than 80% of the

market value of any property unless the mortgage is insured by

mortgage default insurance for up to 95% of the property value.

Mortgage default insurance provides protection for the lender in

case you default on the mortgage.

If you have 20% for the down payment, you

may be able to avoid the default insurance.

There are some lenders who want

you to take out default insurance even if you have more than 20%

down payment on the house. Your mortgage agent will try to find

you a lender who will provide you the best rate without charging

the insurance, but that is where your agent’s experience and

knowledge of the lenders comes in. There are some lenders who

will rely upon a recommendation of the agent and may refrain

from this requirement.

This default insurance can cost thousands

of dollars, but most borrowers simply have the amount added to

the principal of the loan so you don’t need to come up with the

cash to pay the premium. The actual fees range from zero if you

put down more than 20% of the value of the house to as high as

2.75% if your down payment is only 5%.

INCOME VERIFICATION

Once we have all of the above in place, we

then need to verify the income of the borrowers. This can be

fairly simple if you are an employee with a wage or salary and

are issued a T4 slip every year. If you are on salary you will

typically need a letter from your employer verifying that you

are employed and confirming the salary you have reported. The

mortgage agent may even contact your employer to confirm the

information on the letter and indicate that he has done so to

the lender, saving the lender from having to do the same. You

may also be required to provide a couple of pay stubs, so you

should bring those in with you.

If you are a commissioned salesperson or a

self-employed business owner, lenders will usually ask for the

last two or three years Notices of Assessment from the Canada

Revenue Agency. You will be required to bring those documents to

the meeting with you since it can hold up the application

process if you don’t have them.

If you do not have the required Notices of Assessment,

then it is going to be very difficult to qualify for a mortgage

on your own because you will not have any income to factor into

the debt ratios which will be explained later. However, this

will not be a surprise if you are dealing with an experienced

mortgage agent. For example, all mortgage agents with HQ

Mortgages Inc. ask about your income source when you first make

contact with us. If you disclose the fact that you are just

starting out in business and you do not have any proof of steady

income, we will let you know right from the start what you are

up against.

INCOME QUALIFICATION

There are two ratios that lenders will be

most concerned with in deciding on whether to give you a

mortgage or not. Your agent will explain them more carefully

when you meet and he will also ask a lot of questions to

determine if all of the information is being provided. Your

credit record will provide most of this information.

The first ratio is your gross debt service

ratio (GDS). This includes all of the costs associated with your

house. For example, you take your monthly mortgage payment

(principal plus interest), your property taxes and your cost of

heating your house. If you are buying a condominium, you include

half of your condo fees.

You then take this total and divide it by

your Gross Qualifying Income, which is all of your income from

all sources before taxes. Generally, lenders require that your

GDS be less than 32% in order for you to qualify for the

mortgage.

If you are applying for a high ratio

mortgage, where you are making a down payment of less than 20%,

then the mortgage default insurance premium is also included in

the GDS calculation.

The second ratio that needs to be examined

is called the total debt service ratio (TDS). Basically, this

includes all of the payments that a borrower will be paying to

service all of their debt. In order to calculate the TDS, you

take all of the amounts used in calculating the GDS, plus all

other debt payments such as bank and other loans, credit card

payments, car payments, personal loans from family and friends

or some other individual/lender, and any other regular

commitments such as spousal and child support.

It is important to know that items such as

home insurance, life insurance, car insurance and other monthly

obligations that do not repay a borrowed amount are not included

in the TDS calculation. The key question that your mortgage

agent will ask you is, “If you stopped making the regular

payment, would you still owe an outstanding amount?” If the

answer is “no”, then it would not be included in the TDS.

In order to qualify for a mortgage, the

lender will want the TDS to be no higher than 40% of your Gross

Qualifying Income. If this is a high ratio mortgage you are

applying for, then the default insurance premium will be added

to the total expenditures. If it is a condominium, then half of

the condo fees will be added as well.

If your credit score is good, then a lender

may allow the GDS and/or TDS to be a bit higher than the 32% and

40% threshold. Your mortgage agent will likely advise against

going higher than the recommended limits in order to help you

avoid any future problems with the mortgage in the event of

unforeseen problems or expenses.

This is an important benefit of having a

mortgage agent who you can trust and who you feel comfortable

with. Mortgage Agents are held to a very high ethical standard

and will not intentionally give you bad advice. They want you to

be a long-term client. They also do not want to submit mortgage

applications that have a good chance of being turned down

because lenders also keep track of the success ratio of mortgage

agents and tend to deal only with agents who provide them with

complete packages and with applications that meet their

requirements.

So your mortgage agent is acting in your

best interests. If he tells you that in his opinion your GDS or

TDS is at a dangerously high level, even if he can get you a

mortgage, you should listen to him and either look for a house

that is less expensive or wait another year or two before

purchasing. You don’t want to get into a five year mortgage and

find out that at the end of the term your mortgage payments are

going to go up because of an increase in interest rates and then

find yourself unable to carry the mortgage.

FIXED OR VARIABLE RATE MORTGAGES

Your mortgage agent will have a very

serious discussion with you about whether you would like to

apply for a fixed rate mortgage or a variable rate mortgage.

This is a personal decision, so your agent will make sure that

you fully understand the advantages and disadvantages of both.

Traditionally, variable rate mortgages have

had the better track record, coming out ahead of the fixed rate

mortgages over 80% of the time. Variable rate mortgages are also

about 1.5% lower on average than fixed rate mortgages.

Your mortgage agent will be able to let you

know what the mortgage rate trends have been over the past

several years and what the projections are for the coming few

years. If you think the economy is going to remain rather slow,

then interest rates are not likely to go up much. In that case,

a variable rate might be best for you. If, on the other hand you

think the interest rates are going to jump by 2 or 3% in the

coming years, then a fixed rate might be the best decision.

Your mortgage agent will get a feel for

what you are looking for and when the application is made, he

will take that into consideration. All the while, your agent is

searching for the Lender who is willing to provide you with the

best rates and the best terms.

PAYMENT SCHEDULES

Your mortgage agent will talk to you about

some options you have regarding the frequency of payment. For

example you may want to pay monthly, or you may want to pay

bi-weekly. The payment schedule impacts the length of

amortization but it may require you to pay more each month, so

you must be careful when deciding on the strategy that will work

best for you.